Our Materiality

With our corporate philosophy "Towards The Best Asset Management Firm for Your Better Quality of Life.", we provide high-quality asset management services to our clients and as a responsible institutional investor that plays a role in the investment chain we are actively engaged in stewardship activities.

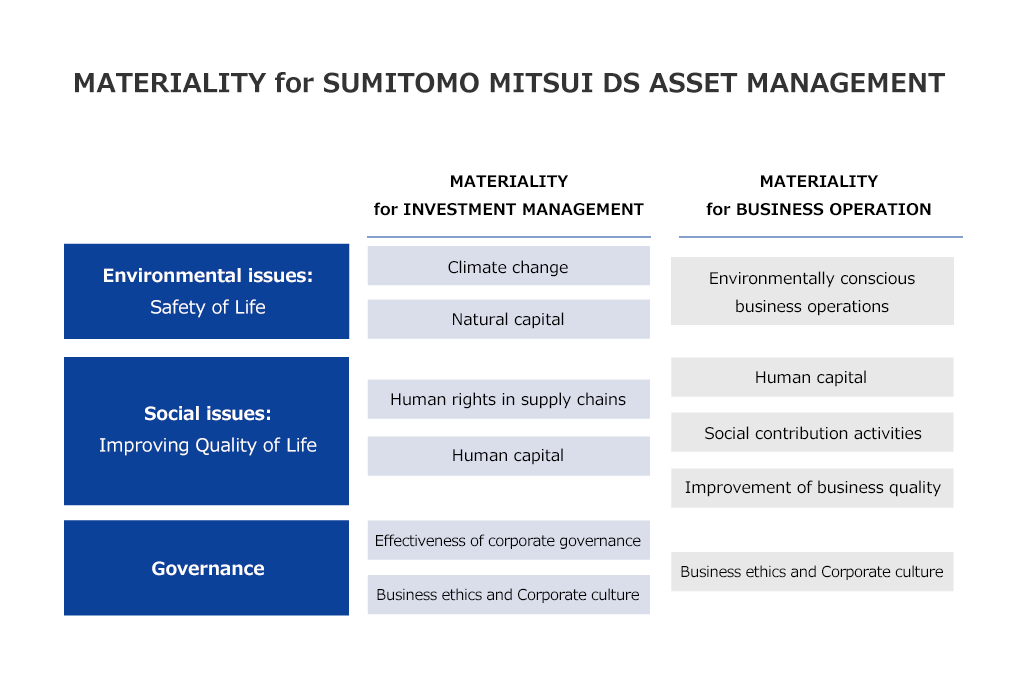

In order to accelerate such efforts and further contribute to the realization of a sustainable society, we have identified a set of materiality as key management issues fundamental to sustainability. Taking into account the characteristics of the asset management business, our materiality categories consist of "Materiality for Investment Management" and "Materiality for Business Operation". The material issues are identified across three areas: "Environment issues: Safety of Life", "Social issues: Improving Quality of Life" and "Governance."

Going forward, we will disclose our achievements with regard to materiality on our corporate website and in the annual Sustainability Report, which is published around November.

Upon the identification of materiality, our "ESG Priority Themes" announced in November 2020 was integrated into "Materiality for investment management".

A process to identify materiality

To identify our materiality, the management team held repeated discussions taking into consideration opinions of a wide range of stakeholders, including employees, external experts, customers and rating agencies, and identified environmental, social, and governance issues among a wide range of issues.

-

STEP 1: Create an issue list

We have made a list of issues for each element of ESG, referring to the Global Reporting Initiative (GRI) Standard, the international standard for preparing Corporate social responsibility (CSR) reports. -

STEP 2: Gather Stakeholder Voices

- Employee Questionnaire Survey

We conducted a survey using a list of issues and received responses from approximately 700 employees, or nearly 80% of employees in offices based in Japan. The results of the survey were analyzed from various perspectives, such as age groups and job roles. - Hearings with external experts

We listened to the opinions of ESG, legal, and accounting experts as well as external peer experts with management experience at global asset management companies. - Due Diligence Questionnaires from customers and evaluators

We scrutinized the questions we answered to our customers and rating agencies to identify their expectations and requests for our company.

- Employee Questionnaire Survey

-

STEP 3: Review by Management and Board of Directors

We held lively discussions led by executive officers in charge of each division who play important roles in the company's management. Thereafter, the Board of Directors finally approved our company's materiality and also set out important initiatives for each material issue.

Materiality for investment management

From the two perspectives, that is "importance in the realization of a sustainable society" and "importance in long-term investment performance," we have identified six particularly important issues as our materiality in the course of investment management.

We will incorporate issues identified as materiality into our proprietary ESG evaluation while we make our engagement activities truly valuable to stakeholders by focusing more on substance than external criteria with targeting key sectors and companies relevant to each material issue. Furthermore, in exercising voting rights, we will encourage investee companies to make broader and more informative disclosure of ESG activities. In situations that disclosure is deemed insufficient and there is no intention of improvement, we may oppose the election of directors at the shareholders’ meeting of such companies.

ENVIRONMENTAL ISSUES: SAFETY OF LIFE

|

Climate change

|

Our view on the issue To achieve net-zero greenhouse gas (GHG) emissions by 2050, a growing number of large companies are demanding their suppliers to reduce their emissions. Responding to such demands has become an urgent issue for companies such as parts manufacturers and other industrials. On the other hand, the shift to renewable energy has adverse effects such as price increases and environmental damage and the capacity to increase renewable energy is not unlimited. Therefore, technological innovation is essential to achieve the 2050 GHG net zero target. In addition to reducing GHG emissions, it is equally important to conserve the forest and marine environment and increase carbon dioxide absorption.

Our Efforts

|

|---|---|

| Natural capital |

Our view on the issue The increase in the world's population and changes in dietary habits are considered as indirect causes of environmental destruction. We believe that the enhancement of food sustainability and the reduction of environmental impact driven by the circular economy are the key to passing on the rich global environment to the next generation.

Our Efforts

|

SOCIAL ISSUES: IMPROVING QUALITY OF LIFE

|

Human Rights

|

Our view on the issue As we observe more countries are moving towards legalizing the human rights due diligence by companies, Japanese companies have been slow to respond, and some companies with global supply chains have not been able to fully grasp the actual situation. In some cases, this is an imminent issue that requires restructuring of the supply chain and other necessary actions promptly.

Our Efforts

Click here for more about our approach on Human Rights Issues. |

|---|---|

| Human capital |

Our view on the issue We believe the recruitment and development of highly skilled staff account for a company's competitiveness to a great extent. In addition, as the liquidity of labor market increases, it is important for companies to improve the work environment and increase their employees’ engagement so that each employee can demonstrate his or her abilities and fulfil their potential.

Our Efforts

|

GOVERNANCE

|

Effectiveness of corporate governance

|

Our view on the issue It has been a long-standing agenda for the Japanese stock market to raise its P/E ratio to the level of markets in major countries. To this end, we believe it is essential to raise management's awareness of the need to enhance corporate value as well as to have a corporate governance that encourages the risk-taking necessary for medium- to long-term growth.

Our Efforts

|

|---|---|

| Business ethics and corporate culture |

Our view on the issue There is no end to scandals such as inspection irregularities and quality falsification by Japanese companies. Among others, closed corporate culture is considered one of the root causes behind such scandals. Meanwhile, in today's rapidly changing business environment, it is necessary to respond quickly and flexibly to changes. We believe it is extremely important for companies to have not only hard aspects such as governance structures and written rules but also soft aspects such as business ethics and corporate culture so that companies can prevent such scandals and take advantage of opportunities brought by changes in their business environment.

Our Efforts

|

Materiality for Business Operation

From the two perspectives, that is "importance in the realization of a sustainable society" and "importance in our corporate sustainability," we have identified five items of particular importance as "materiality for business operation." Built on ongoing activities aiming to improve the quality of life of society, customers and employees, we will make further efforts to develop our human resources and create a sound corporate culture for a medium- to long-term perspective.

ENVIRONMENTAL ISSUES: SAFETY OF LIFE

|

Environmentally conscious business operations

|

Our Efforts

|

|---|

SOCIAL ISSUES: IMPROVING QUALITY OF LIFE

|

Human capital

|

Our Efforts

Human Capital Management at Sumitomo Mitsui DS Asset Management |

|---|---|

|

Social Contribution Activities

|

Our Efforts

|

|

Improvement of business quality

|

Our Efforts

|

GOVERNANCE

|

Business ethics and Corporate culture

|

Our Efforts

|

|---|

Date Updated: October 27, 2023